75% of All New Apartments in 2015 Were High-End, 14 U.S. Cities Saw No New Affordable Rentals

More and more trendy new apartment buildings are springing up in cities across the country. An unusually high number of upscale rental developments are being built at an unprecedented pace, redefining rental markets nationwide. The movement has spread beyond mature metro areas like Miami, FL or San Francisco, CA. The apartment construction focus has shifted significantly, and cities as small as Kansas City, MO or Milwaukee, WI are emerging as the new markets for luxury.

3 out of 4 New Apartments in 2015 Were High-End, Luxury Construction Up 63% from 2012

A closer look at the data reveals that in 2015, 75% of all large multi-family rental developments completed were high-end rentals. The ratio of high-end to total apartments completed increased by a staggering 63% from 2012. In absolute numbers, this translates into 896 luxury multi-family projects of 50+ units (out of a total of 1,188 total projects) completed in 2015, compared to 382 luxury multi-family projects of 50+ units completed 3 years prior.

Moreover, early 2016 data suggests that the luxury apartment market sees no sign of slowdown. Of all large apartment buildings finalized in the first quarter of 2016, 79% were categorized as luxury.

New developments data was provided to us by our sister division, Yardi Matrix, which covers market intelligence information for apartment buildings of 50 units and larger in 115 U.S. metro areas. High-end or luxury rental properties are those classified by Yardi Matrix as discretionary (Class A+/A) and high mid-range (Class A-/B+) properties. More details about the methodology are at the end of this article.

REGIONAL OVERVIEW

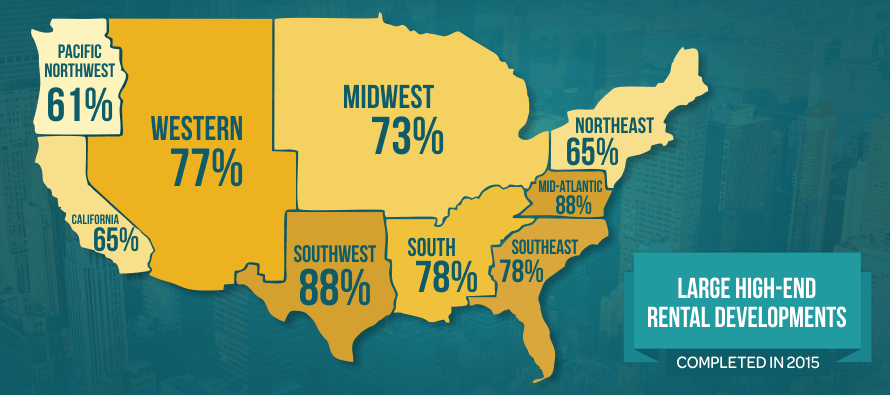

Southwest and Mid-Atlantic Regions Lead in Luxury Construction in 2015

In some U.S. regions, the ratio of luxury apartment buildings to total apartment buildings completed in 2015 was remarkable. The highest percentages of high-end rentals were registered in the Southwest and the Mid-Atlantic (88% of the total number of large rental developments), and in the South and Southeast (78%). The lowest numbers were registered in the Pacific Northwest (61%), in California (65%) and in the Northeast (65%), where the leading metro markets are more mature.

All regions are experiencing an upward trend in new luxury apartment construction in recent years. The most significant increase from 2012 to 2015 in the ratio of high-end to total new apartments was in the Southeast, up by 119%. Over the same period of time, in the Pacific Northwest the numbers went up 90%, and in California 82%. The lowest increase in luxury construction was registered in the Northeast – only 23% up from 2012, and in the Mid-Atlantic – 26% up from 2012.

FOCUS ON METRO AREAS

By the end of last year, 6 metro areas stood out, having built only high-end large apartment buildings. In San Antonio, TX, 17 out of 17 properties that completed construction in 2015 were luxury. The next 5 metros are all emerging markets. Kansas City, MO delivered exclusively luxury rentals in a total of 14 properties, with an average monthly rent of $1,055, versus the metro average of $850. In Milwaukee, WI 10 out of 10 large properties opened in 2015 all classified as high-end with the average rental rate of $1,367 per month. Midland-Odessa, TX is a pretty pricey metro area in terms of rent, with 9 total properties completed, all high-end, charging an average monthly rent of $1,501, which is $402 more than the overall average rent. Jacksonville, FL and Oklahoma City, OK each had 7 out of 7 properties completed in 2015 all high-end rentals. The average rent in a new luxury building in Jacksonville is $1,090, and in Oklahoma City $1,055.

Below are 2 charts showing the top 15 mature metros and top 15 emerging metros with highest percentages of luxury rentals in 2015:

The Top Mature Luxury Apartment Markets of 2015 Are: San Antonio, TX, Phoenix, AZ and Dallas, TX

Nothing but Luxury Was Built in 2015 in Jacksonville, Kansas City, Midland-Odessa, Milwaukee, and Oklahoma City

One new addition to Kansas City’s skyline is the impressive 25-story glass and steel downtown luxury high rise known as One Light Tower, designed by the architectural firm Humphreys & Partners. The 311-unit building won the 2014 Gold Nugget Grand Award and the Special Judges’ Recognition at the 2016 Capstone Awards.

Metro Areas with the Most Spectacular Increases in Construction of High-End Rentals

The shift toward luxury only happened recently, but in some metro areas it was rather spectacular. In Metro Charlotte, NC, a very active real estate market, high-end apartment construction went up by 950%, — from 2 high-end properties in 2012, to 21 in 2015. Metro Atlanta, GA saw an 867% increase from 2012, delivering a whopping 29 high-end apartment buildings to the market in 2015. The area of Midland-Odessa, TX shot up 800% since 2012. The Phoenix skyline also saw major changes, adding 18 new high-end apartment buildings in Phoenix in 2015, up 800% when compared to the 2 completed in 2012. Here are the most active metros in the field of high-end apartment construction:

A LOOK AT THE CITY LEVEL

Renters in 14 Urban Areas Saw Only Luxury Rentals in 2015

As illustrated on the chart below, in as many as 14 U.S. cities, the choice for renters between luxury and non-luxury new apartments was non-existent in 2015, as all large developments opened were luxury rentals. In most cities high-end rentals are on the upswing. But in some urban areas, in particular, we see considerable increases from one year to the next. In 2015, in the City of Fort Lauderdale, FL, luxury rental construction went up 200% from 2014. In Durham, NC high-end construction doubled over the same period.

Texan cities are dominating the charts. Urban Houston, Dallas, San Antonio, Austin, Midland, Fort Worth, and Spring saw a combined total of 103 new luxury rental properties in 2015, and only 6 non-luxury rental properties.

Strong Demand and Rising Rents May Be the Driving Factors

The rapid, undeterred pace at which developers are building is a clear sign of confidence that there is strong demand, driven by certain groups who are opting to rent: renters-by-choice — wealthy households capable of owning, but choosing to rent — like empty-nest baby-boomers and retirees, and lifestyle renters — double-income households — like millennials. Yardi Matrix reports that the average occupancy rate in high-end rental properties was 95.8% as of the end of 2015.

Lured by rising rents, the prospect of steady income and stable cash flows, developers are rushing to build apartments that appeal to more sophisticated generations of renters. The new wave of rental properties offers more than just apartments for rent, it offers an upscale lifestyle. In addition to top-quality interior finishes, high-end appliances, beautiful building architectures, designer landscaping, and coveted locations, they also provide exclusive access to resort-style amenities, first-class fitness centers, concierge services, socializing opportunities and other resident services.

Though it might be profitable for developers, and great for high-income renters, for most renters, the massive shift toward luxury apartments “could put downward pressure on rents for all types of apartments,” as the Wall Street Journal noted in its article New Luxury Rental Projects Add to Rent Squeeze. On one hand, an overall increase in rent prices is a valid economic concern, on the other hand, as new apartment supply comes on the market, older inventory gradually becomes more affordable.

Fewer Options and Higher Prices for Lower- and Middle-Income Renters

Between the overwhelming number of new luxury rentals and rapidly rising rents, the disparity between affordable and non-affordable is widening. In Chicago, IL the average monthly rent in a new non-luxury building, according to Yardi Matrix, is $1,323, but if you want to live in a new luxury building, you’re looking at $2,417 per month (which amounts to an astounding 83% more in rent.) In Baltimore, MD, the average monthly rent in a new luxury building is $1,760, 77% more than in a new non-luxury building.

In Philadelphia, PA, a new luxury rental costs in average $2,145 per month, 75% more than in a new non-luxury apartment. If you’re looking to rent a new luxury apartment in Columbus, OH, you’d be paying in average $500 more per month compared to a non-luxury apartment in new building. And in Dallas, TX, one of the top cities for luxury rental development in 2015, the average monthly rate in a new luxury building is $1,366, an additional $551 per month, or 68% more, compared to the average price of a new rental unit in a non-luxury community.

While lower-income households have been struggling with rising rates for decades, middle-income renters are affected the most by this trend. The rent crunch is climbing up the ladder to middle-income renters. With fewer affordable options, many double-income professionals who used to populate the urban cores are being priced out of the areas where they want to live. They are forced to choose between spending more than they can afford on rent and utilities, or settle for older buildings, in less attractive locations.

Who is RENTCafé and How We Compiled the Data

RENTCafé is a nationwide apartment search website that enables renters to easily find apartments and houses for rent throughout the United States. By working with the top property management companies in the country, RENTCafé’s search tool delivers a comprehensive list of available rental properties and detailed information on prices, amenities and availability.

The data analyzed in this article was compiled from the Yardi Matrix database, RENTCafé sister company specialized in apartment market intelligence, providing up-to-date information on large-scale multi-family properties of 50 units or more. Based on Yardi Matrix’s definition and classification of the apartment market by rental household segments, high-end or luxury rental properties are those that fall into the discretionary (Class A+/A) and high mid-range (Class A-/B+) class categories.